Salt Lake City, December 15, 2025

Last week the 47G Institute held a summit, Critical Ventures: Investing in National Security Materials which took place at the stylish Le Méridien Salt Lake City Downtown. The summit examined how Utah might hold the United States' answer to critical minerals and metals needed for defense capabilities. It brought a variety of speakers from Utah and from across the nation, including geologists, industry specialists, policymakers and leaders to highlight the importance of supply chain security, particulary with regards to critical minerals, and potential innovations for securing vital resources for the country's future.

Featured speakers included Melissa Barbanell, Director of U.S. International Engagement at Washington DC-based World Resources Institute (WRI), provided an overview of the global growth in critical minerals demand.

The Federal Office of Strategic Capital discuss the national imperative surrounding critical minerals, underscoring the necessity of a robust domestic supply chain to meet both commercial and defense-related needs.

Jack Lifton, Co-Chair of the Critical Minerals Institute (CMI) and widely regarded as the world’s foremost experts on critical minerals, provided insights into current market challenges, the distinct needs of consumer and military markets, and the urgent need for government policies that support a vertically integrated supply chain. Lifton’s talk will draw from his recent commentary on the critical minerals sector, with a focus on Ensuring Secure Supply Chains for National Security.

The convening also included feature presentations by leading executives from various companies within the critical minerals industry, including Michael Riley, Founder and CEO of NEXGEN Materials, LLC; Robin Dow, Chairman, CEO, and Director of Nevada Organic Phosphate Inc. (CSE: NOP); Basil Botha, President and CEO of GreenTech Metals Limited; Aaron Dowd, CEO of Rare Earth Salts Separations and Refining, LLC; Chett Boxley, CEO of GlycoSurf, LLC; and Guy Bourassa, President, CEO, and Director of Scandium Canada Ltd. They present insights into their companies’ contributions to the supply chain, highlighting innovations in extraction, refining, and application of critical minerals.

One morning session featured Utah's own Andrew Rupke, Senior Geologist at the Utah Geological Survey, who delved into why Utah has become a key player in the critical minerals industry and what unique advantages it offers for industry growth.

Rupke stated upfront the purpose the Utah Geological Survey and how people can benefit from it: “Our job is to provide timely geologic information, and we are strongly in favor of free exchange of ideas and information in a spirit of cooperation. On our website, there are many great resources and maps that are important for critical mineral areas.”

He continued by covering the minerals found here in Utah while showing many of the excellent maps on the Utah Geological Survey’s website. “Utah is currently producing four critical minerals, we have known resources of nine additional critical minerals, and then we host some other things, but the economics are a little more iffy for those.

He coninued to explain that in 2018, the USGS (United States Geological Survey) put out a critical mineral list which included potash. "Utah is one of only two states in the country that produces potash. Most people know about the big Bingham copper mine to the south. It's certainly Utah's biggest, primarily producing copper, molybdenum, gold, and some other things, but it also produces some small quantities of critical minerals. That's platinum, palladium, and rhenium.”

He added: “Utah is a beryllium producer. It's used in a variety of aerospace and defense applications, and Utah is the leading global producer of beryllium, as it produces somewhere between 60% and 70% of the global supply of beryllium. Utah’s brines are also very high in magnesium and lithium, although hard to separate. More elements found here in Utah, Indium, gallium, germanium, and zinc, are crucial for technology. For instance, indium is critical for touch screens. We also have a sort of specialty potash of potassium sulfate, which fetches a higher price.”

Touching on the southeast of Utah, Rupke explains that Vanadium, an uncommon metallic element, “was primarily used in alloys, but people are also interested in vanadium in grid-scale battery storage for vanadium batteries, and luckily, we have significant resources of it in the state.”

Rupke concludes by quickly mentioning the elephant in the room, uranium. “It was actually removed from the USGS critical mineral list because it's considered an energy mineral. However, Utah did just recently restart some minor production in the Colorado Plateau…”

Melissa Barbanell, Director of U.S International Engagement at the World Resources Institute, and a new resident of Utah who moved here during the pandemic, discussed key initiatives for workforce development and provided an informative overview of key minerals.

Discussing initiatives for accelerating technology adoption, Barbanell asserted, “We've been partnering with the University of Utah and their engineering and scientist groups to understand more technologies better and connect them with the industry. We'll have more events under that topic over the next couple of months.” Barbanell mentions the importance of the inclusion of rural, underrepresented communities and that they have been “working with the Utah Department of Workforce Services through a number of workshops with industry partners to quantitatively, qualitatively understand the workforce requirements for our region.”

Diving into the importance of rare earth minerals, Barbanell gives an overview of the industry, stating, “In 2023 lithium demand rose by 30%, nickel, cobalt, graphite and rare earth demand rose by 8% to 15%. Clean energy applications were the main driver of this growth. Lithium demand is expected to rise significantly, as its used in lubricants, medications, ceramics and glass. Next, we'll talk about copper. Copper is the third most consumed metal in the world. It is used in a vast array of technical applications. It includes construction, transmission of energy, and all sorts of energy. By 2035, the world is projected to need nearly 50 million metric tons of copper annually.”

“Perhaps one of the more interesting minerals, Nickel is used in batteries and stainless steel. In the net zero scenarios, nickel demand will double by 2040, and then, in an ideal scenario, it will grow by about 70%. The market is expected to be flooded with new nickel supply in the next couple of years however, as we near 2030, forecasted shortages are on the horizon.”

Outlining supply and demand, Barbanell is cautiously optimistic that outlined near-future projects will meet demand, although at a high price. “Copper supply is projected to meet 70% of demand. Lithium supply is projected to meet 50% of demand. And nickel may meet demand. The IEA (International Energy Agency) has said that we would need to invest 800 billion US dollars in mining in order to get on track to net zero emissions by 2050. So overall, we are looking at market expansion in this industry.”

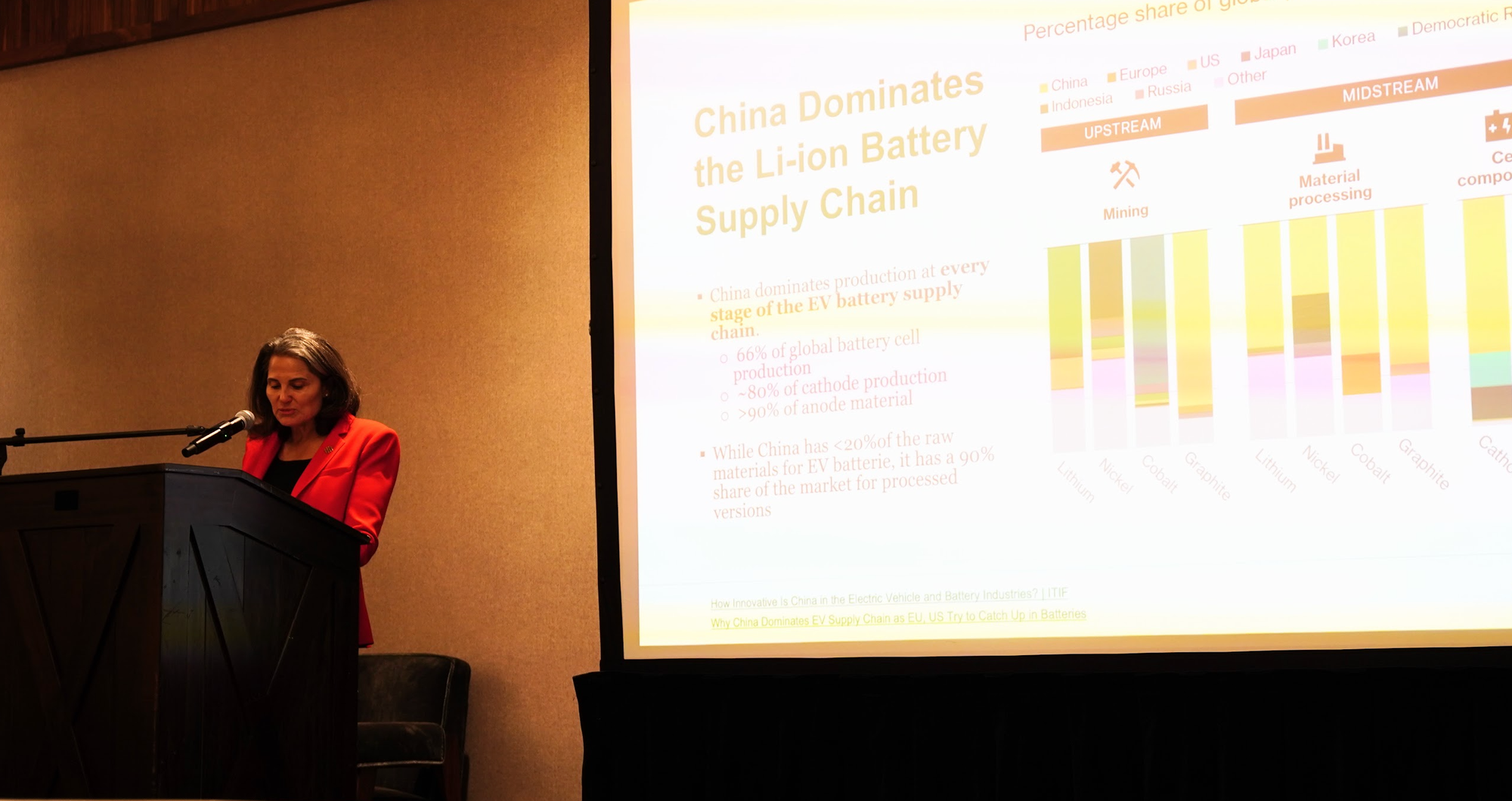

Looking outside the United States, Barbanell highlighted the importance of rare earth metal supply chain security, especially from a global perspective, noting that “China dominates the lithium-ion battery distribution chain, having 66% of global battery cell production, 80% of cathode production, and over 90% of amic material.” Worryingly, “98% of gallium is produced in China, and the US is 100% net import-dependent for gallium, and 50% net import-dependent for germanium.

Barbanell concluded with a remark about one of the most important issues of the 21st century - recycling. “The US has a lot of work to do in regards to recycling capacity. The amount of material to recycle has gone up over the years. As of 2022, there were only four battery recycling facilities operating in North America; two were in Canada and two in the United States. A total capacity of 20,500 tons. China is expected to maintain over 70% of the market share in pre-treatment, treatment, and material recovery by 2030. As of 2022, there were five lithium-ion recycling facilities in China with a total capacity of 188,000 tons, really dwarfing what we have in the United States and Canada.

Sponsored by 47G, through its recently-formed 47G Institute, and the Critical Minerals Institute (CMI), an authoritative resource and global organization dedicated to advancing the understanding and secure supply of critical minerals. CMI connects its members with expert resources, including the Technology Metals Report (TMR) and monthly Masterclasses.

For more information about the 47G, 47G Institute, and upcoming 2025 summits on topics pertaining to aerospace and national defense, visit https://www.47g.org/