Sandy, Utah, October 7, 2024

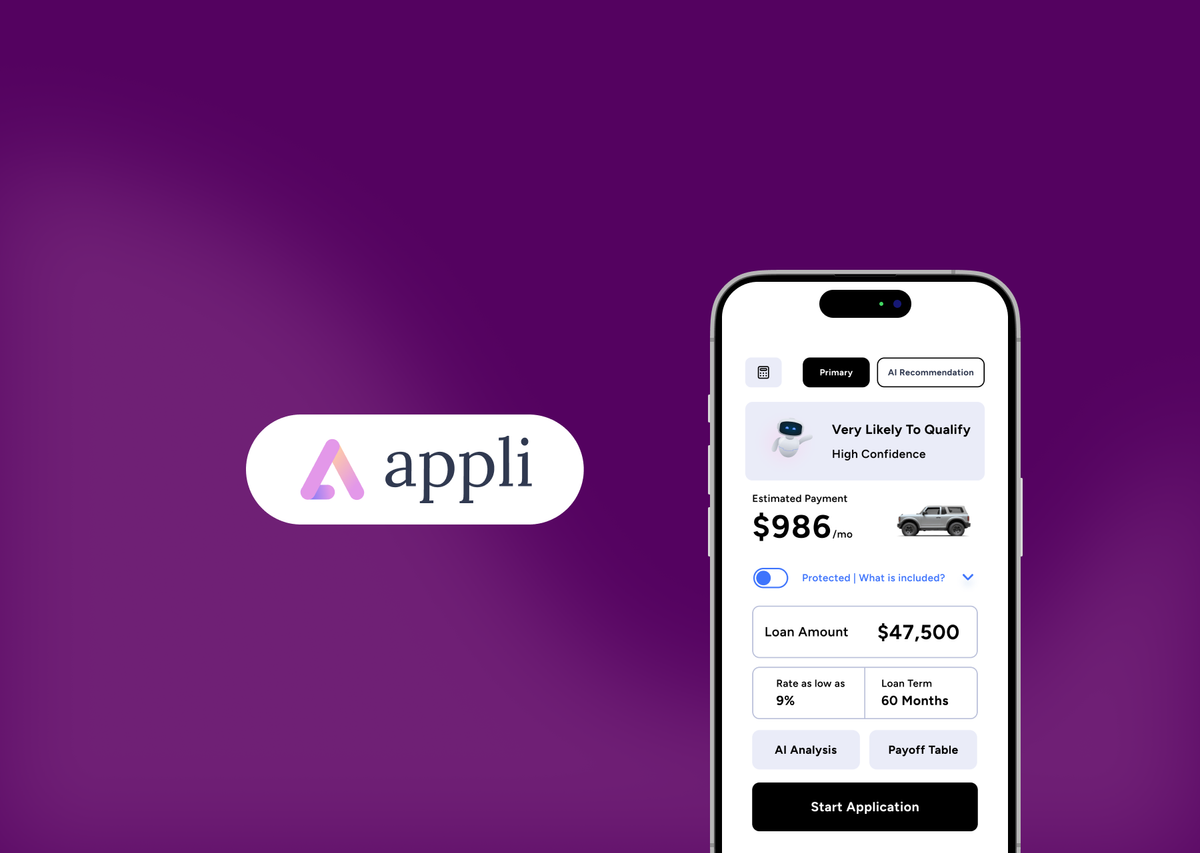

Appli, a SaaS fintech startup headquartered in Sandy, Utah, announced its industry-leading smart loan calculator on October 1, 2024. Powered by a dual AI system, the calculator provides instant feedback to borrowers. Tim Pranger, the co-founder of both POPi/o and Appli, aims to collaborate with financial institutions nationwide to reduce the stress of borrowing.

A bootstrapped fintech startup, Appli was co-founded by University of Utah graduate Tim Pranger. The company recently announced the release of its dual AI-powered, industry-first loan calculator. Knowing how complicated, stressful, and opaque the lending process is for consumers, Pranger set out to improve lending for both consumers and financial institutions.

Appli’s inception, from concept to delivery, began about a year ago when Pranger realized the apparent disadvantages and complexion of the financial calculators large financial firms provide for consumers to rely on.

Pranger explained to TechBuzz, “We took traditional financial calculators and paired them with two forms of AI, one being a confidence model that we built from the ground up, and the second being an LLM (Large Language Model). Based on your input, the confidence model tells you how likely you are to get that loan or product. At the same time, the LLM provides the reasoning behind qualifying or not qualifying for the loan or product, educating you in real time.”

Pranger continued, “Many people out there, including the underbanked, don’t know what they qualify for, and they’re afraid to even start the application. We are trying to reduce and overcome that fear by telling them what their options are ahead of time.”

Regarding the operation and metrics that Appli considers, Pranger stated, "Appli looks at the loan, the term, the interest rate, income, monthly debt, and estimated credit score, compiling all the information for the confidence model to give real-time feedback.”

At the same time, on the other side of loan transactions, Pranger realized that he could answer critical questions for financial institutions, such as “Who wants a personal loan? Who wants an auto loan? What are they looking for most? Can they qualify for it? What's their income? And how do I market to that person more effectively? The goal is to streamline the process for the institution and the consumer.”

Currently, Pranger is working with InRoads Credit Union in Oregon to provide Appli calculators to their members.

However, in the near future, Pranger hopes to “bootstrap and work with at least 10 to 12 financial institutions, providing Appli as a private label and allowing for integration into each company's website. From there, we will see where that takes us.”