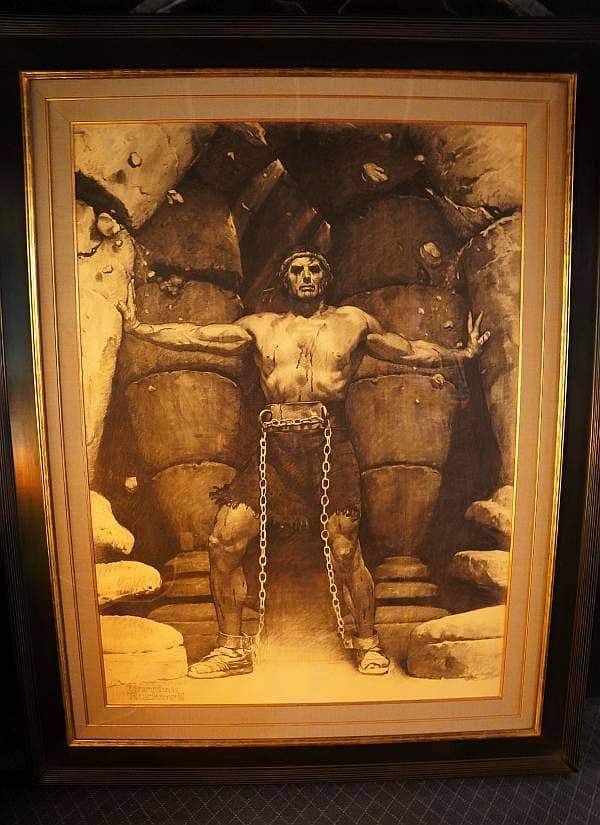

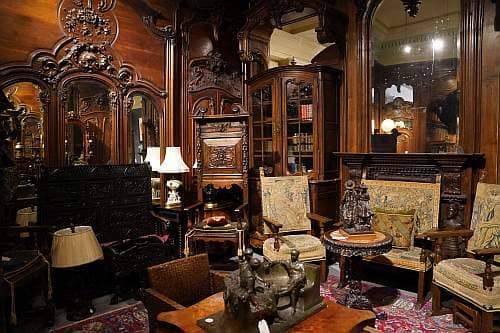

Make an appointment with Anthony’s Antiques in Salt Lake City and the owner, Tony Christensen, may point you to a cloister on the main floor. The room will be lit by a brilliant stained-glass panel (a verified Tiffany Glass original worth $12M, pictured above), and in the other corner, a striking, life-size pencil rendering of a man pushing two stone pillars apart in a fit of glorious determination.  Classic movie buffs might recognize the image from the poster for Cecil B. DeMille’s 1949 epic Samson and Delilah. Others may be simply struck by the artist’s style and flourish, then surprised to find a familiar signature in the lower corner: Norman Rockwell.

Classic movie buffs might recognize the image from the poster for Cecil B. DeMille’s 1949 epic Samson and Delilah. Others may be simply struck by the artist’s style and flourish, then surprised to find a familiar signature in the lower corner: Norman Rockwell.

How does a compelling but little-known piece of movie concept art link to the Utah investor and entrepreneurial ecosystem? TechBuzz sat down with Farmington-based B10 Capital for the story.

How does a compelling but little-known piece of movie concept art link to the Utah investor and entrepreneurial ecosystem? TechBuzz sat down with Farmington-based B10 Capital for the story.

“B10 Capital is a business consultant firm founded on a specific mission: Find innovative, creative, and legal solutions for high-net-worth individuals and businesses to reduce tax expenses, thus freeing up the liquidity, flexibility, and investing power of their income and capital gains,” explains Nate Bradshaw, Capital Impact Partner at B10. “We connect clients with overlooked or unknown tax solutions, better understand options and eligibility to reduce tax burden, and outsource their time and logistics in executing on those options.”

Put another way, B10 Capital is hired to work on unique, ambitious tax projects most people don’t have time or knowledge to orchestrate on their own. While a tax layperson may understand the basics of income or business taxes, they may not be familiar with legal methods to reduce their tax burden. According to B10, one solution can often be found in creative tax credits.

“Here’s what we tell our clients: Income tax liabilities are offset with expenses and capital gains tax liabilities are offset with capital losses, but all tax liabilities can be offset with tax credits,” explains Bradshaw. “This helps free up capital, reduce expenses, and (ultimately) pass benefits along to the client’s business.”

Bradshaw highlights two business tax credits in B10’s arsenal: Research and Development (R&D) credits for business activities investing in process or product improvement (which B10 can help uncover and identify); and Employee Retention Credits (ERC) for businesses to offset payroll expenses for employees during the pandemic.

Bradshaw highlights two business tax credits in B10’s arsenal: Research and Development (R&D) credits for business activities investing in process or product improvement (which B10 can help uncover and identify); and Employee Retention Credits (ERC) for businesses to offset payroll expenses for employees during the pandemic.

For other clients, Bradshaw explains, legally reducing their tax burden may take the form of charitable contributions of unique and culturally significant artwork, historical records, and artifacts—more specifically, those with higher appraisal values than actual purchase price. Hence, B10’s partnership with Anthony’s Antiques.

“B10 Capital has developed a longstanding relationship with Anthony’s as a purveyor of strategic assets for tax donations,” explains Bradshaw. “It’s one piece of B10’s offerings for clients: targeted acquisitions of antiques uniquely suited for this kind of tax mitigation.”

Bradshaw breaks this process down in more detail:

A high-net-worth individual desires to reduce their tax liability. They also meet criteria to be considered an “investor” or, in certain cases, an “art collector.”

A high-net-worth individual desires to reduce their tax liability. They also meet criteria to be considered an “investor” or, in certain cases, an “art collector.”- The IRS requires an asset donation to be mission-relevant to the receiving charity or nonprofit organization (e.g., a museum, religious institution, or university). As such, B10 seeks out a piece with unique cultural or historical significance to qualify.

- B10 initiates an acquisition for an asset optimized for appraisal value—a key number, as it is often higher than actual market value. An actual sale price will be lower than appraisal value, this is what creates the tax benefits. For tax-deductible donations, the IRS approves appraisal value as a calculation for charitable contribution, as long as the item is held for over 12-months. For example, an item bought for $10k could yield $20k worth of tax benefits thanks to a higher appraisal value.

- All asset and appraised values must be verified by a third-party qualified appraiser, and the nonprofit recipient must be a qualified 501(c)(3) organization.

- Once an asset is acquired, the client must own it for at least one year to receive the appraised value.

- After one year, and the client chooses to donate the item, the item is donated to the nonprofit recipient and B10 completes all of the necessary compliance work.

This is how Norman Rockwell’s concept art came to be eligible for a tax mitigation strategy: The Rockwell piece surfaced from the attic of Victor Mature, the actor who played Samson in the 1949 movie Samson and Delilah. One of Anthony’s acquisition partners located the piece through an estate sale following the actor’s death and acquired it.

This is how Norman Rockwell’s concept art came to be eligible for a tax mitigation strategy: The Rockwell piece surfaced from the attic of Victor Mature, the actor who played Samson in the 1949 movie Samson and Delilah. One of Anthony’s acquisition partners located the piece through an estate sale following the actor’s death and acquired it.

“The Rockwell concept art met a tax-benefit sweet spot,” says Bradshaw. “The item was able to be sold profitably for $775k, but had a certified appraised value of $2.5M. Donating an item with a $2.5MM appraised value yields a roughly $1M tax elimination based on a client’s tax bracket. For an individual making that purchase, and ultimately donating it, the net benefit is $225k, or around a 30% ROI. As we like to say to clients, if you can get better than 30% through other investments, you should make those other investments; it would be a sound financial decision to do so. However, there are many cases where a client is able to diversify their portfolio and lock in a 30% ROI, or greater, by buying fine art and donating it to charity. In many cases, it’s a better move.”

Historical and cultural value played a key role in the Rockwell concept art meeting the tax-benefit sweet spot: The piece is impressive and its value is undisputed among appraisers, but offbeat enough that it’s undervalued by mainstream Rockwell collectors. High appraised value combined with low demand was the precise equation for a tax donation that outweighed any purchase or resale value.

But low demand doesn’t mean no demand, and who did demand this piece? The George Lucas Museum of Narrative Art, currently under construction in Los Angeles. Once completed, the museum will highlight diverse forms of visual storytelling, such as painting, photography, sculpture, comic art, video, and (of course) movie posters and concept design.

But low demand doesn’t mean no demand, and who did demand this piece? The George Lucas Museum of Narrative Art, currently under construction in Los Angeles. Once completed, the museum will highlight diverse forms of visual storytelling, such as painting, photography, sculpture, comic art, video, and (of course) movie posters and concept design.

“The Rockwell is an example of a perfect situation,” says Bradshaw. “The purchase price and appraisal were right in line with the criteria we look for, and there was an ideal recipient. Scenarios like this are one of the ways wealthy donors help important works to enter the public domain, and honestly, a piece like this deserves to be in a museum anyway where it can be enjoyed by the public. This is one of the benefits of charitable donations being written into the tax code. Examples like this are how B10’s extensive resources and connections really shine for both our clients and the general public.”

Beyond assisting wealthy donors, B10 also helps leaders of venture-backed startups free up capital through existing business operations, and cut back on costs, rather than having to raise more funds, take on new debt, or require layoffs. “We try to identify all the areas in a company where we can help make a capital impact,” explains Bradshaw. “For most businesses, taxes are their biggest expense, and they don’t understand all of the capital that is available to them through tax credits, tax planning, or tax strategy. A startup can easily extend their runway by 3 to 6 months just by knowing what kind of programs are available to free up capital.”

Beyond assisting wealthy donors, B10 also helps leaders of venture-backed startups free up capital through existing business operations, and cut back on costs, rather than having to raise more funds, take on new debt, or require layoffs. “We try to identify all the areas in a company where we can help make a capital impact,” explains Bradshaw. “For most businesses, taxes are their biggest expense, and they don’t understand all of the capital that is available to them through tax credits, tax planning, or tax strategy. A startup can easily extend their runway by 3 to 6 months just by knowing what kind of programs are available to free up capital.”

For B10 clients, leveling up their relationship with taxes and the government doesn’t have to be a dry, cold expenditure. B10’s experts can turn tax planning into an art—something worth talking about at the dinner table. In fact, B10 Capital hosts monthly lunch-and-learns at Anthony’s Antiques for individuals and businesses interested in innovative tax mitigation strategies. To learn more, reach out to their team.