The 2025 Wilson Sonsini Entrepreneur & Investor Life Sciences Summit took place today at the Sheraton in downtown Salt Lake City. It convened hundreds of entrepreneurs, investors, and operators that are operating within Utah’s thriving life sciences sector, and beyond. Kelvyn Cullimore, President & CEO at BioUtah, Utah's life sciences trade association, kicked off the summit. He stated at the outset that Utah boasts the second-fastest-growing life sciences community in the country, moving up from third place last year.

State Investment in Life Sciences

“Our industry currently generates $22 billion in state GDP and employs 180,000 Utahns—directly and indirectly—at above-average wages,” stated Cullimore. He reported that in the recent legislative session, the state approved $500,000 for a special life sciences workforce initiative aimed at connecting the industry with universities and colleges. The initiative will support on-site placements and internships that provide a pathway to permanent employment.

Cullimore also highlighted the state legislature’s 2024 $4 million Life Sciences Initiative, along with an additional $10 million this year for the Utah Innovation Fund, which has already invested in multiple life sciences companies. “The state of Utah has invested more than $50 million in the life sciences sector over the past several years,” noted Cullimore.

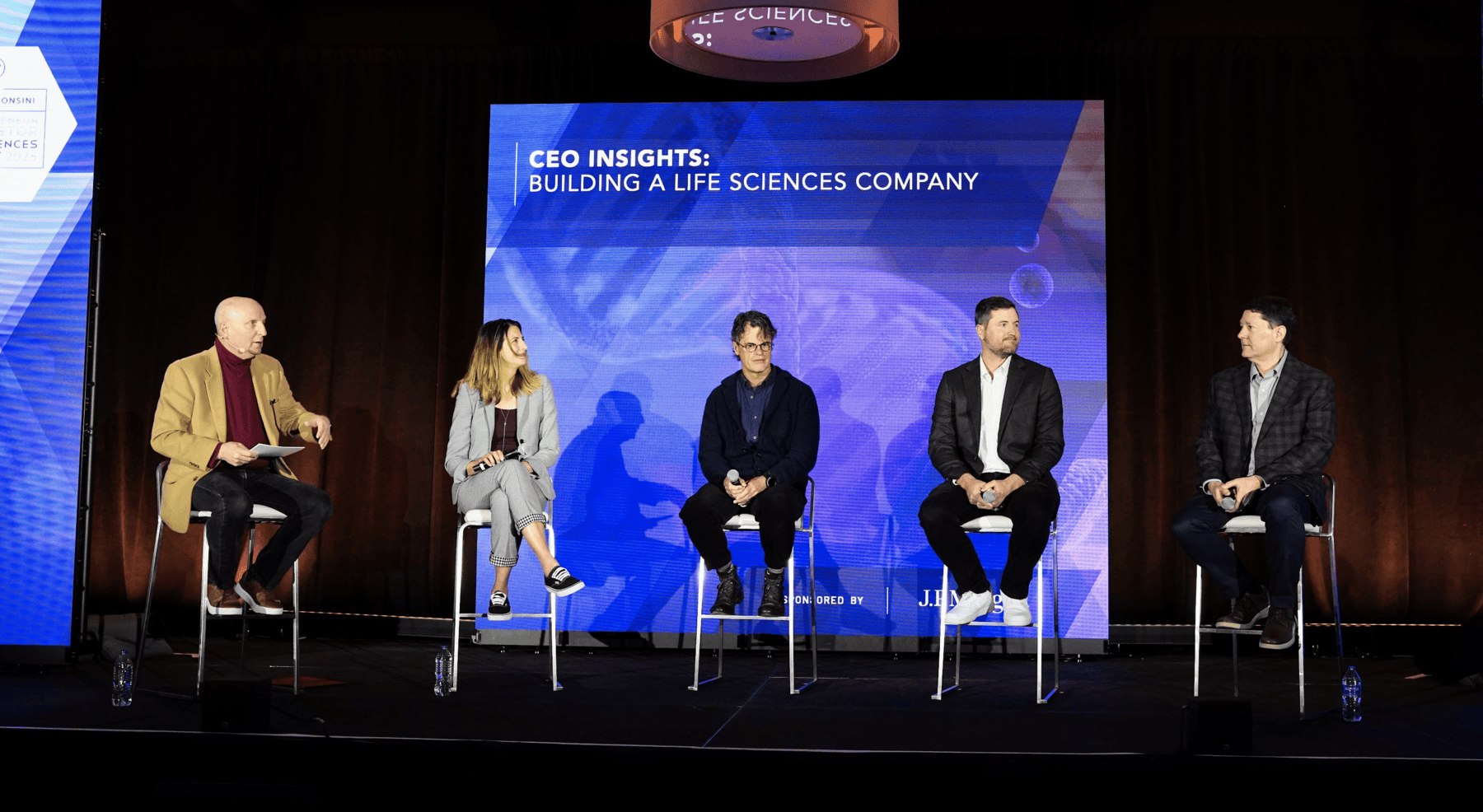

CEO Panel Discussion

Dave Politis, Founder and CEO of Utah Money Watch, moderated the opening panel featuring prominent life sciences CEOs:

- Tina Marriott, former President and COO of Recursion and current board member of Revagenix, with experience ranging from startups to global multinationals.

- Kevin Haehl, Chief Product Officer at Nusano, a physics company dedicated to advancing medical radioisotopes.

- Kurt Workman, CEO and co-founder of Owlet Baby Care, a Lehi-based public company focused on infant health via technology that monitors infant pulse, heart rate, and sleep through the night.

- Jay Muse, CEO of Piper Access, with over 30 years of experience in innovation, engineering, technology development, and commercialization.

What Sets Their Companies Apart?

Setting the stage, Politis asked the panelists how their companies differentiate themselves from competitors.

“We are leveraging artificial intelligence, automation, and other cutting-edge technologies to revolutionize drug discovery,” replied Marriott. “It’s a very different way to innovate—not just in technology but in business as well.”

Muse addressed a common issue in IV therapy: “IVs typically last about 48 hours before half of them fail. Instead of turning patients into pincushions, our solution is a single device that lasts throughout their entire therapy.”

“Owlet makes a wearable heart monitor for babies,” stated Workman. “One in ten newborns in the U.S. now goes home with an Owlet. We’ve collected the largest infant health dataset, and our goal is to help parents navigate their child’s health.”

Haehl emphasized Nusano’s unique approach: “Our technology enables the large-scale production of specialty radioisotopes, something that hasn’t been possible before. This breakthrough is opening new frontiers in cancer treatment and has applications beyond healthcare, including clean energy and aerospace.”

Advice for CEOs

Politis asked the panelists to share advice for fellow Life Science CEOs.

“Think about funding, but also focus on strategic investors,” advised Marriott. “Strategic alignment between investors and the company is always important, but never more so than in an uncertain economic environment.”

Muse cautioned against overpromising: “I never followed the 'Elizabeth Holmes' method of making promises that weren’t backed by reality. Instead, we worked closely with clinicians before seeking funding. Many people make money doing the opposite, but we chose to put the horse before the cart.”

Workman encouraged persistence: “You're going to hear a lot of ‘no’s. That doesn’t mean there’s something wrong with your business—it just might not be the right fit for that investor. Keep going.”

Haehl added, “Investors know tech and life sciences are inherently risky. You need to show them what makes your offering unique and how it stands out from the many pitches they hear.”

Key Lessons from Experience

Politis closed the discussion by asking panelists to share key lessons from their experiences.

“These companies are expensive to build,” said Marriott. “The average drug takes 15 years and $2–$3 billion to reach the market. While a billion dollars seems like a lot, it’s actually the kind of capital necessary to create a sustainable company in this industry.”

Workman emphasized customer feedback: “From the beginning, we had what we called our ‘mom army’—a group of 100 parents who tested every iteration of our product. That approach helped us refine our product, and when we launched, we quickly became the number-one monitor at Target and Walmart.”

Muse reflected on his shift to healthcare: “Consumer electronics come and go. I wanted to build something that actually matters. I was tired of corporate bureaucracy, so I left in 2015 to pursue something meaningful.”

Haehl concluded with a focus on infrastructure: “To succeed, you need the right technology, workforce, and logistics. Utah happens to have a strong physics and nuclear science talent pool, making it a key hub for the growing radiopharmaceutical sector.”

The panel provided diverse perspectives from industry leaders, offering valuable insights into the future of life sciences in Utah.

To learn more about the event, and insights from other sessions, visit the website for the 2025 Wilson Sonsini Entrepreneur & Investor Life Sciences Summit.