Provo, Utah, April 12, 2024

“We’re not early, mid, or late stage venture capital, we’re 'Exit Stage,'” said Paul Burgon, Managing Partner of new Provo-based investment company, Exit Ventures.

Burgon was previously the CEO of the Utah company Vortechs (a company previously covered by TechBuzz), focused on bringing plastic recycling to Utah Valley and the rest of the world. He sold the company last year and recently launched Exit Ventures with a business partner.

Burgon has been a CVC (Corporate Venture Capital) and corporate M&A investor for most of his career, funding 500+ startups and investing over $3.1 billion as a corporate/strategic investor. He has closed dozens of M&A transactions to create/expand multiple multi-million dollar platforms including electronics testing, water quality, dental equipment, motion control, and aerospace & defense.

Burgon is currently the co-chair of the Keiretsu Forum's Northwest & Rockies Clean Tech Committee. Founded in 2000 in San Fransisco, Keiretsu Forum is a worldwide network of capital, resources and deal flow with 52 chapters on three continents. It is one of the nation’s largest super angel groups and invests over $75 million a year.

Burgon is currently the co-chair of the Keiretsu Forum's Northwest & Rockies Clean Tech Committee. Founded in 2000 in San Fransisco, Keiretsu Forum is a worldwide network of capital, resources and deal flow with 52 chapters on three continents. It is one of the nation’s largest super angel groups and invests over $75 million a year.

Burgon uses his corporate investing experience to screen for startups that are likely to be acquired, or he doesn’t invest in them. “After we invest, we run them through a multi-year process to create strategic partnerships and prepare them for a strategic exit,” said Burgon,

He added, “We’re the only VC fund in the nation that I know of whose sole fund focus is using their core corporate expertise to screen for strategic exits, create strategic partnerships, and proactively create strategic exits.”

Regarding the current goals of the fund, Burgon stated, “We’re focusing on cleantech and sustainability for our first fund and are close to investing in three deals: single-use plastic replacement, long-duration energy storage, and energy as a service.”

“I believe that all three have the potential to become unicorns, they have very disruptive tech in massive global markets,” said Burgon, “What’s more, I’ve brought global strategics to the table for all three of them, and have a verbal offer to buy one of the startups for 5x my valuation.”

“I believe that all three have the potential to become unicorns, they have very disruptive tech in massive global markets,” said Burgon, “What’s more, I’ve brought global strategics to the table for all three of them, and have a verbal offer to buy one of the startups for 5x my valuation.”

“We create strategic partnerships and we create strategic exits. That’s what we do, and I think we do it really well," said Burgon.

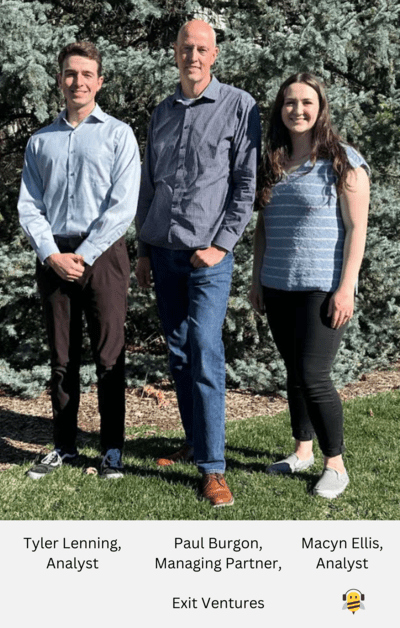

The Exit Ventures team currently consists of four members: Paul Burgon, Tyler Lenning, Macyn Ellis, and another founding partner whose name is withheld until he joins the firm shortly. Burgon hinted, “This upcoming partner has extensive startup investment process experience, with over $300 million in startup investments, and is widely known in the West Coast startup industry.”

For more information on Exit Ventures, visit their website, follow the company on LinkedIn, or reach out to Paul Burgon at: paul@exitventures.net.