“If you live in Sandy, Utah, would you travel to Vermont to ski?” asks Scott Frazier, a lifetime skier/snowboarder and a venture capital investor for 34 years. As Managing Director of Frazier Group, Scott and his team like to compare Utah’s unsurpassed snow, world-class resorts, and extraordinary canyon proximity to the state’s vibrant tech marketplace and entrepreneurial talent.

“If you live in Sandy, Utah, would you travel to Vermont to ski?” asks Scott Frazier, a lifetime skier/snowboarder and a venture capital investor for 34 years. As Managing Director of Frazier Group, Scott and his team like to compare Utah’s unsurpassed snow, world-class resorts, and extraordinary canyon proximity to the state’s vibrant tech marketplace and entrepreneurial talent.

"We’re far ahead of the pack in all of them," says Scott Frazier.

We sat down with the entire Frazier Group to learn about their passion for Utah venture investing and Utah tech. As senior member and founder of the team, Scott Frazier initially invested in Utah tech decades with around twenty angel partners. And more recently the Fraziers have been operating a series of tech-heavy VC funds collaborating with nearly 100 limited partners.

Now Frazier Group announces a new level of partnership—a full-service, multi-family investing office. Scott Frazier said this office "caters to the full spectrum of financial needs with investments across the various asset classes." The new multi-family Frazier office is open primarily to the families of harvested tech entrepreneurs in the state.

According to family office database, Fintrx.com, “A multi-family office… caters to the needs of multiple high-net-worth families under one organization. By pooling resources, MFOs provide a wide range of services while benefiting from economies of scale and cost efficiencies.”

According to family office database, Fintrx.com, “A multi-family office… caters to the needs of multiple high-net-worth families under one organization. By pooling resources, MFOs provide a wide range of services while benefiting from economies of scale and cost efficiencies.”

Associate Louise Frazier says, "the typical wealth manager or family office invests primarily in public equities and bonds, with alternatives mostly an afterthought." By 'alternative,' Frazier Group refers to individual private companies, funds that invest in private companies, and real estate, explains Louise. Her brother, David, is emphatic that “private markets are not ‘alternative’ to us. They’re our bread and butter and yield the lion’s share of our upside.”

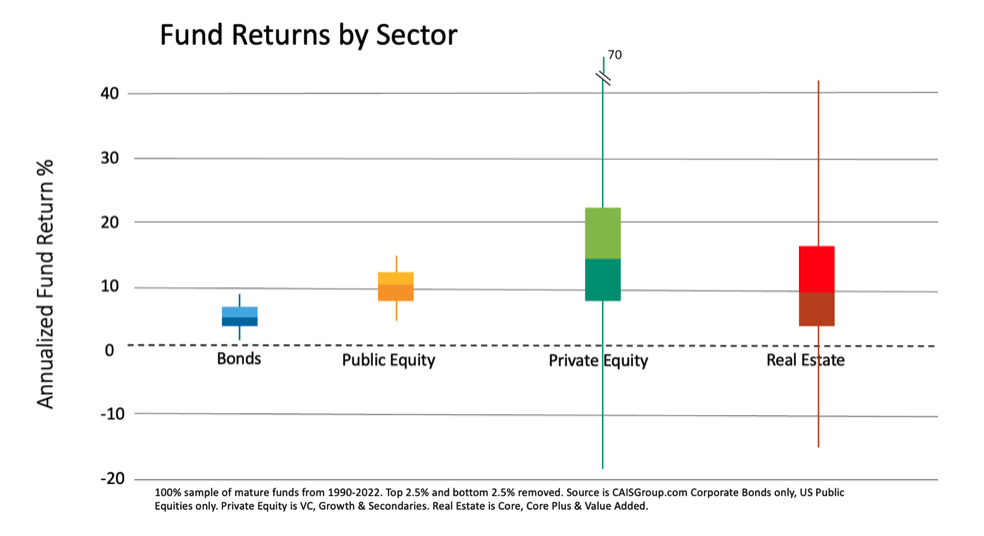

Colter Conway, Frazier Group CFO, offers the following fund comparison chart in support of the firm's new position.

Colter Conway, Frazier Group CFO, offers the following fund comparison chart in support of the firm's new position.

"We have compiled performance data showing that Utah VC funds have outperformed the Private Equity sector by four percentage points." said Conway. "Our own funds have outperformed Private Equity by eleven points," he added.

"Considering the variability inherent in each asset class (represented by the whisker above and below each bar) even the harvested tech entrepreneurs in our group don’t choose to keep all their assets in the high return/high risk sectors of Private Equity and Real Estate," said Conway.

Liv Gheciu, a Frazier Group Partner, cautions that even if you are very good at Private Equity or Real Estate investing you’ll want to take extensive measures to mitigate risk.

Liv Gheciu, a Frazier Group Partner, cautions that even if you are very good at Private Equity or Real Estate investing you’ll want to take extensive measures to mitigate risk.

"We control risk by spreading private company investments over many companies and by placing our largest bets on later-stage companies," said Gheciu.

Currently, the Frazier portfolio consists of 51 companies with 80% of the invested capital in companies from $30 million to $1.2 billion in annual revenue.

Managing Director, David Frazier cautions that this approach isn’t for everyone.

Managing Director, David Frazier cautions that this approach isn’t for everyone.

"We bring an even temperament, a track record of success, and a long term perspective to Utah tech. For the harvested tech entrepreneur, why not couple your expertise and connections with us to deploy substantial capital in Utah tech?”