Over the past few years a lot of people have been talking about the “lithium crisis.” Lithium production has ramped up a lot, but so far, the numbers aren’t adding up to fill global needs.

Last year, more than 10 million electric vehicles were sold worldwide, a 60% increase over 2021, according to the World Economic Forum. Here in Utah, our long-term energy plan relies heavily on solar power. No new coal generators have been built here since 1993. In 2022, 16% of Utah’s electricity came from solar sources, ranking us 9th in the US for solar generating capacity. Rocky Mountain Power even has an incentive program to help solar users invest in solar battery storage that helps take pressure off the grid. All of the interest in solar is great for the environment, but it is causing some concern that the main raw material in high-capacity batteries––lithium––will soon be difficult to obtain.

It is clear that the market is changing, and there is a lot to figure out surrounding lithium, demand and consistent supply chains. Battery production will only increase, as more and more people realize the value of energy storage as part of their broader green energy strategy and as technology catches up to make the necessary batteries more cost effective.

The rise in battery production over the last couple of decades has undoubtedly increased the need for lithium, but the rise in demand has not been as steady as you might think. At the beginning of this year, for example, fewer Americans were installing residential solar panels than in previous years, possibly due to the slowing of the economy. And in China, electric vehicle sales were down with the end of a cash subsidy on EVs sponsored by the government.

Both markets are expected to rebound, but there is an unpredictability to the current lithium supply chain that makes it a risky investment in some ways. A lithium mine can take up to 10 years to open, depending on the political climate of the area, the ease of getting permits, the accessibility of the ore itself, workforce availability and a variety of other factors. More lithium sources have opened up in recent years, meaning there is a greater supply, but the price has dropped, so now fewer companies are looking to get into the lithium game.

As you can see, the market has a way of accounting for increases in demand, and we are already seeing adjustments that give battery manufacturers reason to hope that the lithium crisis isn’t likely to last very long. New sources, new technologies and new government policies will help to correct the lithium shortages we have seen in the past, pointing to a bright future for clean energy storage.

Lithium availability is not as dire as we think

The US Geological Survey estimates that there are 88 million tons of lithium locked in the Earth’s shallow crust, enough to produce hundreds of billions of kWh worth of battery storage. Utah has lithium deposits all over the state, thanks to residue from Lake Bonneville, which covered somewhere around 20,000 square miles of Utah thousands of years ago.

The problem, then, lies not in how much lithium is available, but how quickly we are adapting as a civilization in order to get to it. We can now get lithium from liquid brine processes instead of more costly mining procedures. As the value of lithium increases, it will become more attractive to commercial enterprises to research and develop new ways of reaching those deposits.

This is already happening here in Utah. An Ogden company called Compass Minerals has plans to extract lithium brine from the Great Salt Lake, generating up to 25,000 metric tons of battery-grade lithium each year. And in Tooele, US Magnesium has started recycling waste products to produce lithium. One company in Las Vegas, A1 Lithium, is exploring mining opportunities in Paradox Basin in the area around Moab.

These new opportunities are good for the state’s economy and for the environment, but they likely don’t go far enough in solving the lithium shortage. That is why my solar company Humless, based in Lindon, is focused on changing the way we use lithium, so that batteries need less of the precious resource to function. For example, lithium iron phosphate batteries improved upon lithium-ion technology with batteries that last longer, are easier to recycle and are safer to use. More efficient batteries will decrease the volume of lithium we need to make the shift to more renewable energy sources.

These new opportunities are good for the state’s economy and for the environment, but they likely don’t go far enough in solving the lithium shortage. That is why my solar company Humless, based in Lindon, is focused on changing the way we use lithium, so that batteries need less of the precious resource to function. For example, lithium iron phosphate batteries improved upon lithium-ion technology with batteries that last longer, are easier to recycle and are safer to use. More efficient batteries will decrease the volume of lithium we need to make the shift to more renewable energy sources.

Lithium is not the only answer

Even as the industry works to stretch our current lithium supply and make it easier to procure, it is important to remember that lithium batteries are not the end of the road for green energy. Other technologies are already in development, with more to come.

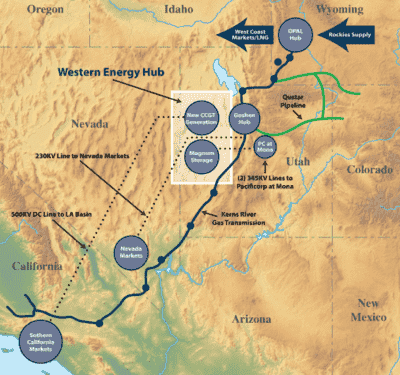

One promising solution on the horizon is compressed air batteries. Holladay-based Magnum Development has already developed five underground caverns in Utah's West Desert that store energy in the form of liquid salt. Next they want to develop more underground deposits that take green energy, such as solar and wind, and store them as compressed air. Although in the early stages of development, these batteries have the potential to be a more efficient and cost-effective way to store energy than traditional battery technologies. And they do not require the use of lithium or rare earth metals.

One promising solution on the horizon is compressed air batteries. Holladay-based Magnum Development has already developed five underground caverns in Utah's West Desert that store energy in the form of liquid salt. Next they want to develop more underground deposits that take green energy, such as solar and wind, and store them as compressed air. Although in the early stages of development, these batteries have the potential to be a more efficient and cost-effective way to store energy than traditional battery technologies. And they do not require the use of lithium or rare earth metals.

There are also a variety of chemical batteries in development that do not rely on lithium. Solid electrolyte, graphene and metal-air batteries are all alternatives to traditional lithium batteries that are more energy dense. The development of new chemical batteries is an active area of research, and it is likely that new and improved technologies will be developed in the coming years. These new technologies could help to make batteries more affordable, efficient, and sustainable.

There will always be a demand for lithium batteries, but odds are, we will find other ways to store energy in the right circumstances long before the earth runs out of lithium.

The demand for lithium has changed drastically over the last two decades. As with any new or drastically changing market, there has been a lot of uncertainty, evolving regulations, and new technologies to take into account.

As solar panel and EV production ramps up, so will our need for lithium. But as the market develops, the pros will start to outweigh the cons, and lithium will be even more rewarding for businesses and investors. Interest in alternative energy sources is not going away. Panic over the availability of lithium isn’t something we have the luxury for. Instead, Utah is focusing on the ways we can move beyond it.

Let's see if the rest of the country follows our lead.