Jump Capital, a Chicago-based venture fund founded in 2012, has built a reputation for its adaptability and thesis-driven investment strategy. Saaya Pal, a partner at Jump Capital, recently sat down with TechBuzz to discuss the firm's evolution and its growing interest in Utah’s tech landscape.

Jump Capital specializes in fintech, infrastructure, and enterprise software, following a deeply thesis-driven approach. Pal, who focuses on enterprise software, notes that the firm maintains a nuanced strategy for identifying promising startups. This approach allows Jump to stay competitive against larger funds by demonstrating a deep understanding of emerging sub-sectors.

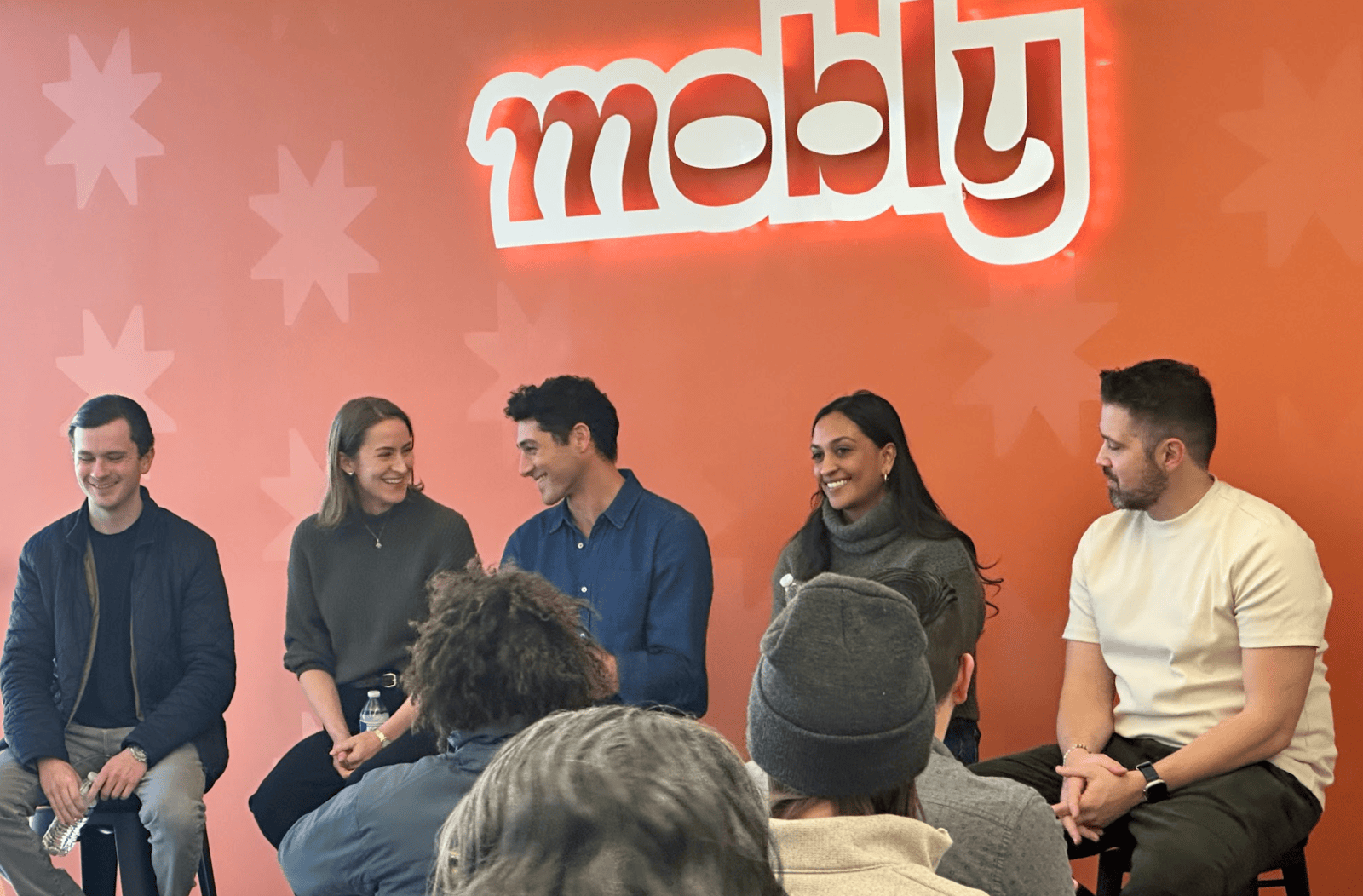

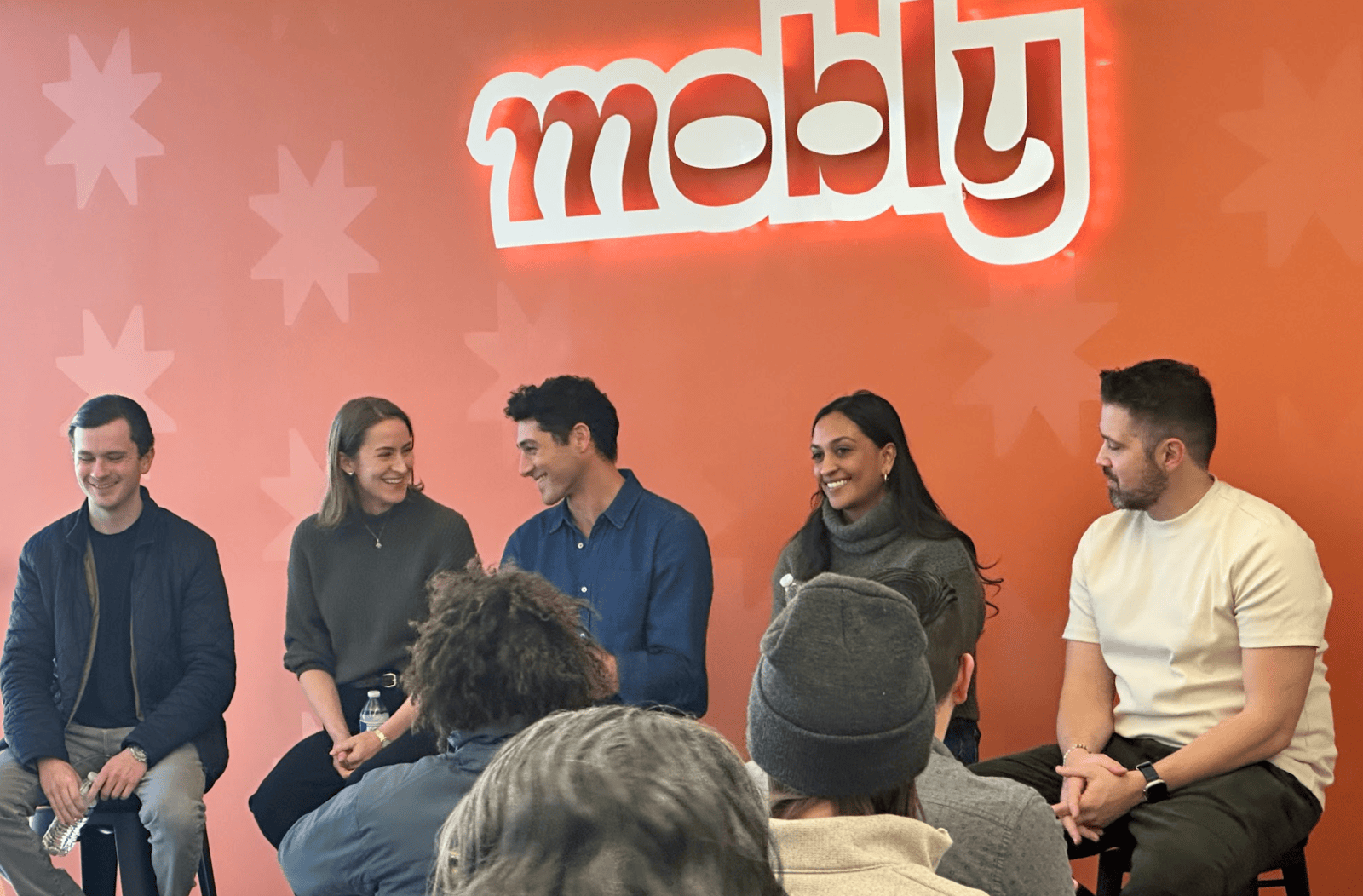

Pal highlighted that Jump primarily invests in Series A rounds, with occasional seed investments. Its latest deal in Utah was a $4.3 million seed investment in Mobly, which it co-led with New York-based Eniac Ventures.

"Raising a Series A is actually one of the hardest rounds to raise," said Pal. "We think there's always room for more capital."

She elaborated on Jump’s perspective on geography and investment focus:

"At first, we avoided crowded markets like the Bay Area and focused on deeply researching specific sectors to develop strong investment perspectives. But as we spoke with founders, we realized that sticking to both a strict investment thesis and geographic limits made it harder to identify the best opportunities—especially in emerging markets. So, we adjusted our approach. Now, we don’t have strict geographic restrictions, but we actively seek out high-potential regions, like Utah, where we’re increasing our presence."

Pal is leading Jump’s efforts in Utah. Although she is relocating to New York soon, she plans to visit Utah regularly. Last month, she attended Utah Tech Week, where Jump hosted a full capacity happy hour for the Utah ecosystem at Lake Effect in downtown Salt Lake City. The event connected her with dozens of Utah-based startup founders, many of whom were introduced through Jump’s existing portfolio company founders.

"I find the Utah ecosystem to be very collaborative and supportive," Pal noted. "I'm still building my network here, and Utah Tech Week played a big role in that. I met many key people, which is exciting. I think there’s going to be more deal flow in Utah."

Utah has become an increasingly attractive market for Jump Capital, particularly in enterprise software at the application layer. While fintech opportunities are emerging, most of Jump’s investments in the state align with its existing enterprise software thesis.

Pal also highlighted an interesting trend in Utah’s startup community:

"What stands out in Utah is the number of founder referrals we receive—not just from Mobly but also from founders outside our portfolio. Even if a company isn’t a fit for us, or it’s too early, founders here still make introductions, saying, ‘Hey, I think this company fits your thesis.’ That level of community support is refreshing."

Jump Capital was founded in 2012 by Sach Chitnis and Mike McMahon, who saw a gap in mid-country funding at a time when venture capital was concentrated on the coasts.

Jump’s involvement in Utah is not new. In March 2015, Jump led a $22 million Series B investment in Draper-based Degreed.

Jump continues to engage actively with the upskilling edtech company. As Utah’s tech scene grows, Pal anticipates increased competition from other venture capital firms. “We are making a concerted effort to establish a stronger foothold in Utah as the market matures and garners more investor attention.”

Jump Capital’s expanding presence in Utah underscores the state’s rising influence in the tech sector. With a growing number of high-quality startups and a collaborative entrepreneurial community, Utah is poised to attract even more venture investment in the years to come.

For more information visit Jump's website.