SoloSuit closed a $2 million over-subscribed seed plus round. Investors include McPike Global Family Office (Bahamas), Lobster Capital (San Francisco), Mana Ventures (San Francisco) and Temerity Impact, a Washington DC family office. Local angel investor, Jeffrey Tolk (Provo), also invested in the round.

Additional investors include Tubbs Ventures (Salt Lake City) and David Fox, a former managing partner at large law firm, Kirkland Ellis.

Jeffrey Tolk, a graduate of Harvard Law School and Provo-based angel investor, said, "I worked as a litigator for several years in New York City, and I have always looked for technology-based solutions that could automate the litigation process and level the playing field between wealthy corporations and ordinary citizens. SoloSuit is one of the best, most promising solutions I have seen. It's already profitable, and I see huge growth opportunities ahead for the company."

Y Combinator (Mountain View) and Kleiner Perkins (Menlo Park) previously invested in SoloSuit.

Based in San Francisco and Utah, SoloSuit streamlines the process for consumers to settle debt with collectors.

SoloSuit's Founder and CEO, George Simons sat down with TechBuzz this week to share the founding story of his startup, details of the recently closed funding round, which he described as a Seed Plus, and he walked us through how things are going.

A joint JD/MBA student at BYU, Simons had an inclination for entrepreneurship. His interests flourished when he encountered law professor Kimball D. Parker at the J Reuben Clark Law School. Parker was one of the founders of LawX, the legal design lab and incubator of new legal products and services that was founded around the same time (2016-17) that Simons was showing interest in a legal services startup concept. As it turned out, Simons became a part of the very first LawX cohort, and SoloSuit became one of the first products created in the then-new LawX program

In 2018 SoloSuit was released as a free tool specifically for Utah debt holders to create a document in response to debt lawsuits. Between 2018 and 2020, SoloSuit remained a free product only for Utah users. Then in late 2020, SoloSuit launched nationally to satisfy demand in other states.

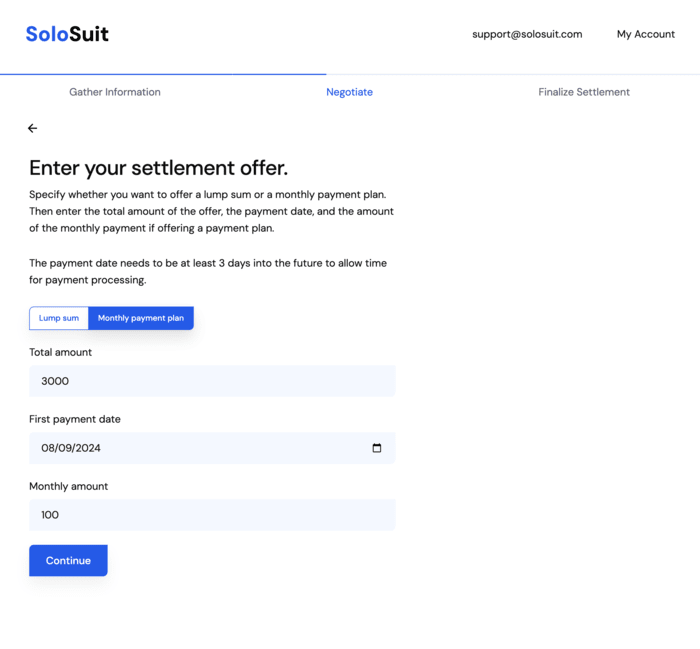

"Initially we were just helping people respond to debt lawsuits," said Simons. "Consumers would thank us for the easy way to respond to debt collectors, but they came back asking if there was a way we could actually settle the debt with the collector. Debt settlement is usually the number one desired outcome for the consumer. So we looked into it. We found that collectors' number one desired outcome is also to settle. As both sides wanted to settle the debts, we created the platform, SoloSettle, which connects the consumer with the collector for the purposes of settling debt. It became the first digital debt settlement marketplace. SoloSettle is a solution for what a lot of people report as being 'the worst financial pain of their entire lives.'"

Simons began to describe the enormous debt settlement problem in the US that his company is addressing.

"About 70 million people in the US are in collections annually," said Simons. "We've helped a small fraction of them. We want to expand to help all of them."

"Most people find SoloSuit via Google search or other search engines. The internet is full of content to help people understand how debt lawsuits work, what they need to do to resolve them, how to respond to debt lawsuits, how to settle the lawsuit," Simons pointed out.

He said that many people being sued don't even know the entity that is suing them. They initially search the plaintiff's name for details. This is when they encounter SoloSuit most of the time. SoloSuit posts their helpful, how-to articles and they rank organically within Google search results. Consumers get educated through these articles on the often unpleasant how-tos of debt settlement, what they can expect, and how they can make it easier on themselves. Engaging SoloSuit is the goal of the Google campaign, but at a minimum, SoloSuit educates the consumer on the grim downside of ignoring debt collection attempts.

"Oftentimes, consumers have never heard of the organization that is suing them," said Simons. "Let's say a consumer has a debt with Discover Bank, but now they're being sued by, let's say, Midland Funding LLC. The consumer doesn't know who Midland Funding LLC is. They'll search that name to see if it's a legit lawsuit. Midland Funding is the biggest debt buyer in the US. The consumer realizes the suit is legit. Those consumers then discover SoloSuit in their search process. They quickly find out that we can help them get through what otherwise could be a very painful process."

Simons explained that less than 10% of people even respond to debt lawsuits. Their non-response triggers an unpleasant process that only worsens the situation for them. He shared with TechBuzz some of the advantages consumers have enjoyed by engaging SoloSuit to settle their debts:

"If consumers don't respond to the debt lawsuit, they can't settle. Most people don't respond. However, when they use SoloSuit, it puts them on the right track to settle, and they can do so in a much shorter time frame, and they save themselves a lot of money and pain," said Simons.

Traditionally, it can take up to six months to get a debt settlement, explained Simons. "There are many phone calls, a lot of back and forth, waiting on hold, missed calls and voicemails. Not a fun process. SoloSuit has built relationships with collectors. They know who we are. They're familiar with us. They know we can save them money and time." said Simons.

He continued, "We connect the consumer directly to the collector. We get the case settled usually in under 14 days. Often, we'll settle the case within three to four days, and for a significant discount off the original amount.

Simons explained that when a person settles on their own, the best deal they'll get from a collector is a payment plan that they can pay down the full amount over months or years. Instead, when consumers use SoloSettle, "we're able to hack off thousands of dollars off the person's debt," said Simons.

SoloSuit receives a commission on the total amount once the consumer has settled and the collector has been paid.

Currently debt collectors are only able to collect on about 15% of their accounts. SoloSuit is a value add for collectors because all of the consumers on the SoloSuit platform have a high intent to settle.

"We're building towards a path where all of the cases on our platform settle, which is a win for the consumer and a win for the collector.

Should a consumer decide to ignore a debt collection attempt, "they can get into a really bad spot," said Simons.

"They'll automatically lose the lawsuit because they failed to respond. There will be a judgement. The collector will win the judgement against them. Their wages will be garnished. The federal maximum for garnishment is 25% out of every paycheck. On top of that judgment, 10% statutory interest will be added on top of the already compounding interest on the original loan amount. The collector will also add on a few hundreds of dollars in attorneys fees, usually a few $100 in attorney's fees. Often, the consumer will end up owing two to three times more than they were being sued for at the beginning of the trial."

SoloSuit's key advantage is that it eliminates the need for phone calls between the collection agencies and the consumer. Debt collection is still very phone-based. Collection agencies employ large call centers that constantly call millions of consumers to resolve outstanding debts. It is an inefficient, labor-intensive and expensive process for the collector. By allowing the consumer to bypass the phone process and negotiate on the critical points of the debt via an automatic process through the SoloSettle app, the creditor (the plaintiff), can more easily recover more of the debts, and thereby be more willing to grant a better deal for the consumer, because the collector is saving money on the expensive call-center debt collection efforts. "So really, this is a win-win across the bar," said Simons.

To date, using SoloSuit platform over 230,000 consumers have brought over $1.5 billion in debt on to the platform.

For more information, visit SoloSuit's website.

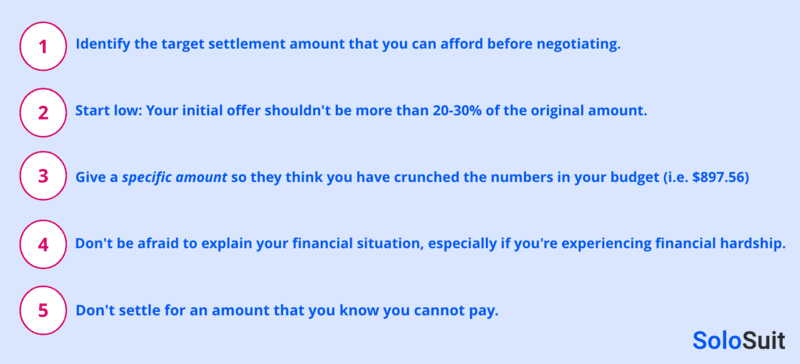

See SoloSuit's guidelines and tips for debt settlement: