Latest Articles

295 Articles

Announcement

Articles in the "Money" category primarily relate to a funding announcement of some sort, typically from an institutional investor such as a venture capital firm, or from a family office, an angel investor, or any combination of private investors. These stories focus mainly on the funding details (who, when, how much, what it will be used for, etc.)

Articles in the "Money" category primarily relate to a funding announcement of some sort, typically from an institutional investor such as a venture capital firm, or from a family office, an angel investor, or any combination of private investors. These stories focus mainly on the funding details (who, when, how much, what it will be used for, etc.)

Consensus, a Lehi, Utah-based intelligent demo automation platform, announced it has raised a $110 million Series C investment from a single investor, Sumeru Equity Partners, based in San Mateo, California and New York. The company has raised nearly $139 million total since it was founded in March 2013 under the

Hypercraft Inc. announced it has raised a $6.5 million seed funding investment at a post-money valuation of $51.5 million. The round was led by RevRoad Capital, with participation from individual investors and early customer angels. “Hypercraft is a high-growth company that we’ve had our eye on for

Monarx (Salt Lake City) has raised $6.1 million in funding, a round led by Signal Peak Ventures (Salt Lake City). Kickstart Fund (Salt Lake City), Pelion Venture Partners (Salt Lake City), and Crosscut Ventures (Los Angeles) also participated in the round. Monarx will use the money to help it

by Mark Tullis

Monarx (Salt Lake City) has raised $6.1 million in funding, a round led by Signal Peak Ventures (Salt Lake City). Kickstart Fund (Salt Lake City), Pelion Venture Partners (Salt Lake City), and Crosscut Ventures (Los Angeles) also participated in the round. Monarx will use the money to help it

by Mark Tullis

Consensus, a Lehi, Utah-based intelligent demo automation platform, announced it has raised a $110 million Series C investment from a single investor, Sumeru Equity Partners, based in San Mateo, California and New York. The company has raised nearly $139 million total since it was founded in March 2013 under the

by Mark Tullis

Hypercraft Inc. announced it has raised a $6.5 million seed funding investment at a post-money valuation of $51.5 million. The round was led by RevRoad Capital, with participation from individual investors and early customer angels. “Hypercraft is a high-growth company that we’ve had our eye on for

by Mark Tullis

R-Zero today announced it has closed a $105 million Series C to continue scaling the adoption of its UV-C technology to address a growing health crisis: disinfecting the indoor air we breathe. Investors include BMO Financial Group, Qualcomm Ventures, and Upfront Ventures, and existing investors DBL Partners, World Innovation Lab,

by Mark Tullis

Today Mercato Partners (Cottonwood Heights) announced the close of Traverse Fund IV, a $400 million growth fund that will be deployed to high-growth, mature technology and branded consumer companies. Traverse Fund IV is Mercato's largest fund to date. The company says it is the largest growth only vehicle

by Mark Tullis

Kickstart, a seed-stage venture capital firm with offices in Utah and soon-to-be Colorado, announced today that it has closed its sixth fund along with a dedicated follow-on fund. Combined, these funds represent an additional $230 million in fresh capital to be invested in startups in the Mountain West (UT, CO,

by Mark Tullis

Facta, Inc., a SaaS financial technology company co-headquartered in San Francisco and Salt Lake City, has announced it has raised a $4 million of seed round. Inner Loop Capital, Point Field Partners, and a group of individual investors participated in the round. This capital will enable Facta to further advance

by Mark Tullis

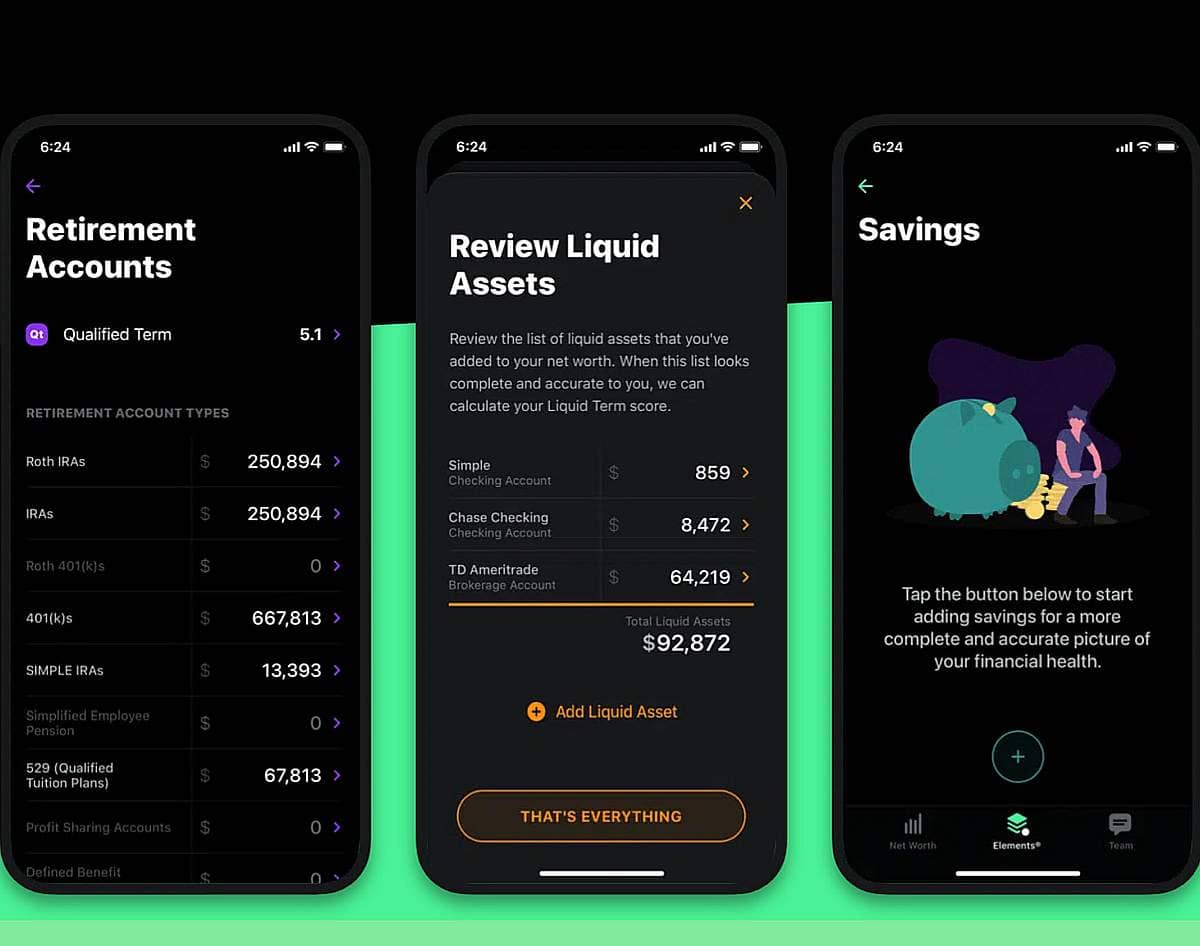

Elements is a mobile financial monitoring platform based in Salt Lake City. It announced on January 24, 2023 it has raised $5 million in seed extension financing to support its continued growth trajectory. The round was led by Flyover Capital of Kansas City, and was joined by existing investors Kickstart

by Mark Tullis