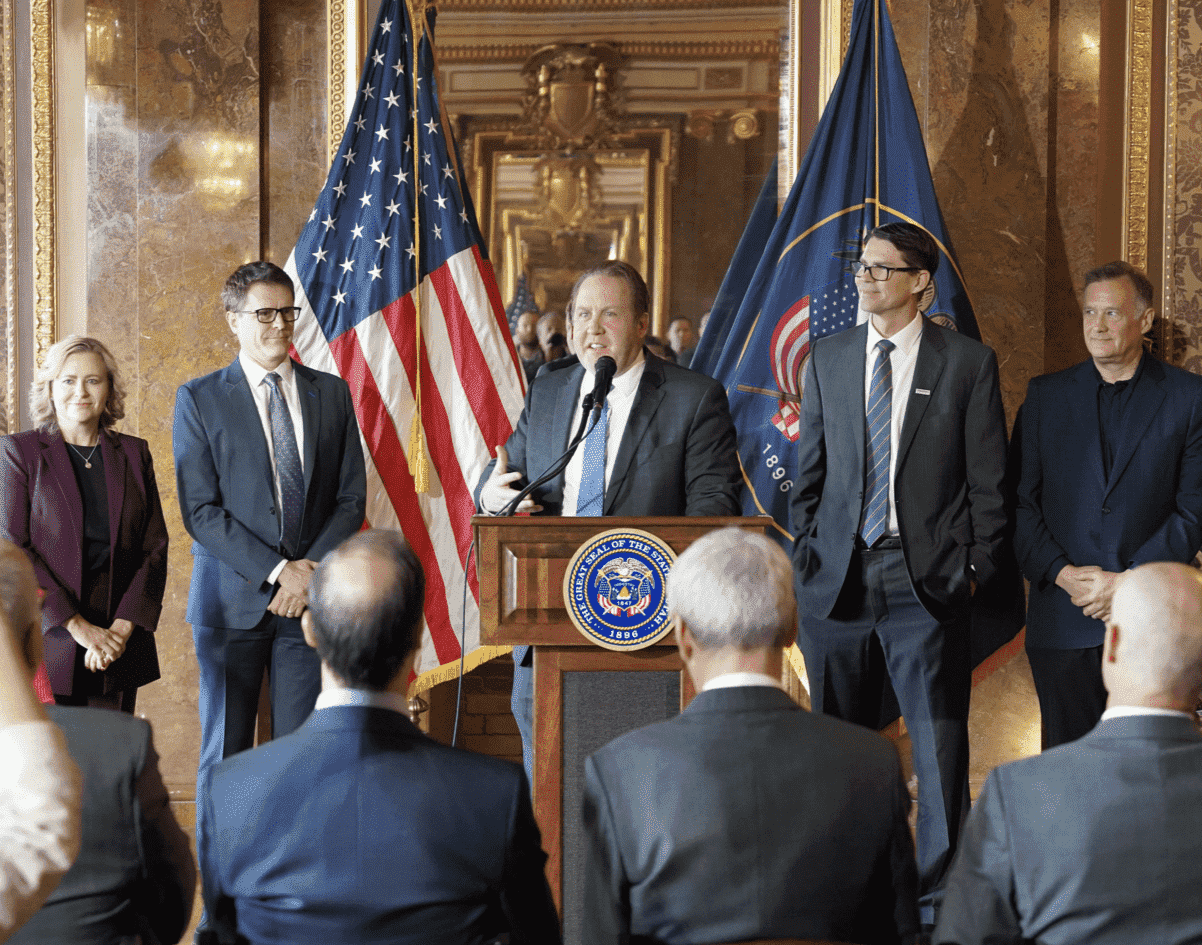

The Utah Innovation Fund, a new $15 million fund born out of HB 42 of the 2023 state legislative session, held a public kickoff event today at the Capitol. In the lavishly appointed Gold Room, the managers of the Fund and a relaxed Governor Spencer Cox announced the Fund's purpose, introduced its Board, and presented its plan for investing in technology companies that align with the state's strategic growth initiatives, particularly in Advanced Manufacturing, Aerospace & Defense, Energy & Natural Resources, Healthcare & Life Sciences, Outdoor Productions & Recreation, as well as Software & IT.

HB42 was sponsored by Rep. Jeffrey Stenquist (District 46, Salt Lake County) and Senator and Majority Whip Ann Millner, (District 5, Davis, Morgan and Weber Counties).

Utah is well-known for having a robust investment sector investing in SaaS and enterprise software companies. The Utah Innovation fund will emphasize investing in startups focused on "deep tech" or the areas mentioned above that are not entirely focused on software and apps.

Governor Spencer Cox opened the event with a strong show of support for this new fund and for the thriving entrepreneurship culture in Utah.

Governor Spencer Cox opened the event with a strong show of support for this new fund and for the thriving entrepreneurship culture in Utah.

Rep Jefferson Moss, the Fund's legislative champion (among others) and one of its Managing Directors responded, "It's not by happenstance or coincidence that our state is doing such a great job. And I think in large part, we have a great governor who's leading and feels so strongly about entrepreneurship."

He added. "Our job is just to help provide support in areas that maybe the private market can't fill."

Rep. Moss said the intent of this fund is to complement existing investment in the state's entrepreneurs and to address a gap in the market around deep tech funding. "One of the challenges is when you get into the deep tech commercialization space, there really isn't funding available to support it. We looked across the nation and found a fund similar to this. And so it's great that Utah is able to do this and complement the wonderful things that we're already doing here."

The Utah Innovation Fund is "patient capital," said Gabbi Tellez, Managing Director of the Fund. "As investments, a lot of these areas take a very long time to mature," she explained. "It'hard for a traditional venture capital fund to take those early bets; We're in a unique situation where we can come in and support these companies."

The fund plans to connect its companies "with later stage venture capitalists and other investors to talk about investing in them once the Utah Innovation Fund gets them farther down the line," added Tellez.

The fund plans to connect its companies "with later stage venture capitalists and other investors to talk about investing in them once the Utah Innovation Fund gets them farther down the line," added Tellez.

She explained how the fund will measure its success and how it is applying a long time horizon on its investment strategy:

"The way we measure success and the way we're thinking about this fund, is a focus on solving big, impactful problems. We're looking at a long time horizon. We're not looking at traditional IRR over the next couple of years. We're hopeful that in 10 to 12 years that we can look at money that has been returned from any of these companies go back into the fund. We want to have a fund that's self sustaining—an evergreen fund. But our focus is on impact and problem solving."

Rep. Moss elaborated on this point, "There really isn't a lot of capital in Utah that's doing this type of investment."

Rep. Moss elaborated on this point, "There really isn't a lot of capital in Utah that's doing this type of investment."

"One of the main things that we hope to do is to be that source of capital so that outside investors know that there's been a group that's already done the due diligence....hopefully bringing more capital to the state."

He added, "I would say that's a big part of how we measure success is the future rounds. We're heavily incentivized to help those companies be able to go out to the community both here in Utah and across the country to be able to secure additional funds. That's a large part of our motivation."

The Fund also offers support services including an operator database, business service network and industry advisors.

Tellez and Moss called attention to the fund's unique relationship with the state's network of universities. It is implementing an analyst program that engages university students throughout the state consisting of "interdisciplinary teams of engineering, policy students, as well as the traditional business finance students working together to look at these investments and to understand how they fit within the landscape."

The Fund has made three investments to date: Inherent BioSciences, 3Helix and Eden Technologies.

Eden's CEO and Co-founder, Hunter Manz—one of the main speakers at the event—said his company is focused on the elimination of water scarcity in the world. Manz and his St. George-based team have developed a novel system that makes desalinization more financially viable and environmentally sustainable.

"We're thrilled to be the fund's first investment," said Manz, "We can't think of a better investor to help us fulfill the goal of our company. It is our goal to offer solutions allowing the world to turn towards the vast oceans and underground reservoirs of brackish water to present endless amounts of cheap clean drinking water. Our team hopes to continue scaling quickly and allowing the world to have access to our technology. So the scourge of drought and all its accompanying suffering and aggravation can be banished."

"We're thrilled to be the fund's first investment," said Manz, "We can't think of a better investor to help us fulfill the goal of our company. It is our goal to offer solutions allowing the world to turn towards the vast oceans and underground reservoirs of brackish water to present endless amounts of cheap clean drinking water. Our team hopes to continue scaling quickly and allowing the world to have access to our technology. So the scourge of drought and all its accompanying suffering and aggravation can be banished."

He remarked on the funding gap that this fund addresses:

"When I tell folks about our work, the typical focus is always on the technology and the effort it took to develop it....but the development of the technology was the easy part. By far I've spent most of my effort in business development, and especially fundraising. I thought once the technology was even remotely proven out that a myriad of high quality investors would come pouring in (laughter from the audience). I was mistaken. Because the venture capitalists are not interested in backing a hardware company—a company making physical tangible goods. They want software—software is safe and easy to scale. Even those that claim they're interested in backing companies looking to change the world are almost always only looking for solutions that are created through software. I have news for them. Software by itself will not save the world. We need real physical solutions. Lucky for Utah, the rest of the world, they're already here."

Funding from the Utah Innovation Fund is not a grant. As is the case with private investment groups, the Fund will take an equity position in the companies it invests in. In addition, the Fund will use financing instruments, such as SAFE notes, depending on the situation, explained Tellez.

Funding from the Utah Innovation Fund is not a grant. As is the case with private investment groups, the Fund will take an equity position in the companies it invests in. In addition, the Fund will use financing instruments, such as SAFE notes, depending on the situation, explained Tellez.

Click here to read more about the Utah Innovation Fund's investment review process. It is managed by two Managing Directors, Jefferson Moss and Gabi Tellez, and Operations Manager, Tori Hooper.

Final investment decisions are made by a seven-member Board of Directors consisting of seasoned individuals who have operated both bootstrapped and venture-backed startups and large multinational corporations. They are: Mark Paul, David Carlebach, Cydni Tetro, Barclay Burns, Christian Iverson, Tom Ngo, and Jefferson Moss.

For more details about Eden Tech, see TechBuzz News' March 2022 article about Eden's website launch and seed funding announcement.

For more information about Inherent BioSciences, see TechBuzz News August 2023 article about the company, its founding team, its fertility innovation and its recent NIH award.